There is no denying that the vast crypto ecosystem grows more and more. Such boost can be justified, mainly, by the rise of DeFi.

However, the question that remains is: What is DeFi and why does everyone in the crypto market talk about it? Read on and find out!

What is DeFi?

Before explaining why DeFi is the most talked subject among crypto users, it is necessary to make clear the meaning of this important term.

Decentralized Finance (DeFi) is the name given to carrying out direct transactions between cryptocurrency users.

Through smart contracts (programmable digital contracts) and autonomous exchanges (DEX), users can transfer amounts without intervention or censorship by intermediaries. In this way, all transactions are properly registered on a public blockchain and without the risk of manipulation.

Another advantage of decentralized finance is lower maintenance costs, since there are no physical facilities or employees. The only fees to be paid come from transactions that take place in blockchains. These, in turn, usually vary according to the network used in the decentralized application.

DeFi also allows users to participate in the decisions of each application. Among them, whether or not a new crypto can be accepted or not as collateral in loans.

In some cases, when users are charged fees or gains, profit can be distributed among the holders of this token.

In crypto land, Descentralized Finance is the king

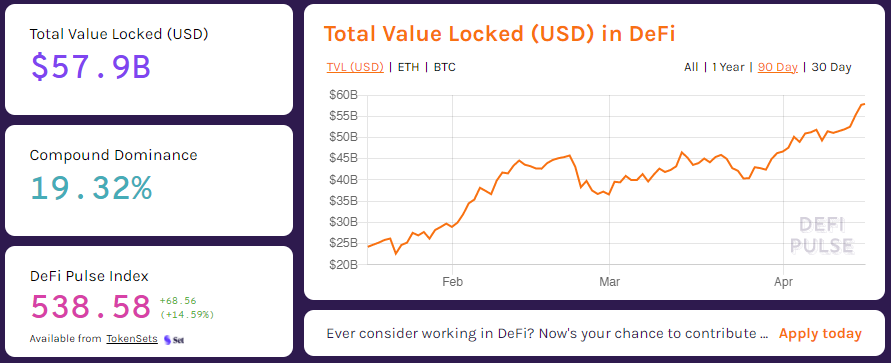

Between September 2017 and August 2020, the total blocked value (VTL) on DeFi contracts jumped from $ 2.1 million to $ 6.9 billion. If we analyze only the month of August, this jump was US $ 2.9 billion, according to data from DeFi Pulse.

The great growth of these contracts has resulted in a massive increase in market capitalization of all the negotiable tokens used for DeFi smart contracts.

Currently, DeFi TVL is $ 59.7 billion. The value represents a composite dominance of 19.32%. In 2020, the TLV of the DeFi market was US $ 939.507 million. Which means that in just one year the market grew over 50 times.

Data from The Block Research reveals that DeFi is the fastest growing sector in the cryptocurrency market.

According to the 2021 survey, the native tokens of many decentralized finance projects had a more linear price growth than compared to the last year.

In addition, several of the largest decentralized financial projects have seen great growth, such as Aave and Sushi. Their tokens have quadrupled since the beginning of this year, according to DeFi Pulse website.

“DeFi fever”

There are some reasons that justify the fact that DeFi is a trend.

1. Financial innovation vs. regulators

The main reason for the growth of decentralized finance is due to the fact that many regulators were lacking innovation and DeFi took advantage of this gap to grow exponentially.

Unlike traditional transactions, in DeFi there are no legal requirements and crypto users do not need to have their identities revealed. Transactions are more “libertarian”, and everything revolves around mutual trust and the preservation of privacy.

Regulators now have to decide between either stifling innovation and failing to protect society from risk as individuals putting their money in an unregulated space, or banks and other financial institutions being potentially unable to continue the services as intermediaries.

In July last year, the United States Securities and Exchange Commission (SEC) made a major change towards DeFi adoption by approving an Ethereum-based fund, the Arca, for the first time.

2. Greater investment in blockchain technology and popularization of DApps

A second reason for the boom in decentralized finance is the engagement increase of gamers in this market. In 2018, Coindesk surveys concluded that 62% of players and 82% of developers would be interested in digital assets transferable between games. Since then blockchain games and decentralizeds apps (DApps) have become even more popular.

In addition, many large financial institutions are beginning to accept DeFi and are looking for ways to be a part of the growing market. 75 of the largest banks in the world are testing blockchain technology to accelerate payments as part of the Interbank Information Network.

Asset management funds, like leader Grayscale, are also starting to take decentralized finance seriously. In the first half of 2020, the network managed more than USD$5.2 billion of crypto assets, including USD$4.4 billion of Bitcoin.

3. DeFi and Covid-19

The Covid-19 pandemic caused global interest rates to drop further.

Some countries in the EU, for example, now have negative interest rates. The US and UK may soon follow.

In this context, decentralized finance offers investors far greater returns. In 2020, Compound, a leading decentralized token algorithm, offered an annual interest rate of around 6.75% to investors with Tether‘s stablecoin. Beyond annual interest rates, investors also receive compensation tokens, which is a bonus.

With about 2/3 of people without bank accounts in possession of smartphones, decentralized bonds have the potential to open up the finance world for them.

4. Desire to belong to the growing DeFi market

Another reason why more and more people invest in decentralized tokens is the fear of being left out of their explosive growth (also called FOMO, Fear of Missing Out).

Many decentralized tokens are not very valuable in practical terms. However, we are moving towards an increasingly liberal and decentralized financial system.

The challenge for the coming years is to find out the best way to continue the development of this new system, in order to mitigate risks and generate greater returns.