Venture capital firms seeding into the crypto industry indicate no signs of slowing in 2022, with major investors continuing to endorse promising startups in niche industries spanning the metaverse, non-fungible tokens (NFTs), and play-to-earn (P2E) decentralized applications “GameFi.”

Animoca Brands Leads $7.5M NFT3 Raise

Animoca Brands, a Hong Kong-based blockchain game and virtual property developer, recently led a $7.5 million funding round to develop a decentralized identity and credit network platform NFT3.

The funding initiative also saw the participation of LD Capital, CMS Holdings, Tenzor Capital, Ankr Network, DFG Group, Prometheus Labs Ventures, and others. Moreover, Animoca has also launched a $30million guild program for Play-to-earn ecosystems.

NFT3 are described as non-fungible tokens used for Digital Identity Systems (DIDs). Yat Siu, the co-founder of Animoca, described these NFTs as “cornerstones of identity in Web3” and an increasingly important component of the metaverse.

Hartmann Capital Launches Metaverse Fund

Hartmann Capital, a crypto-oriented investment firm, successfully raised $30 million for its Metaverse Fund. The firm now intends to invest in various aspects of the metaverse sector, including infrastructure, content, and access points. The company announced that it wants to pursue additional investments in NFT.

Arca Secures $50M NFT Fund

Arca, a crypto asset management firm, recently launched a hedge fund product that would allow financial institutions to integrate non-fungible tokens (NFTs) into their portfolios. The NFT Arca Fund will focus on digital property, digital collectibles, in-game assets, and identity tokens. The $50 million Arca Fund aims to generate a yield from NFT purchases.

Hyperspace Raises $4.5M To Expand NFT Market

Hyperspace, an NFT marketplace aggregator on the Solana network, secured $4.5 million in a funding initiative that saw the participation of Jump Capital, Galaxy Digital, Coinbase Ventures, Solana Capital, and others. The company intends to fund product development, build in-house capacity and increase other marketing efforts.

776 Management LLC Participates In $100M Web3 Growth Fund

776 Management LLC, a venture capital firm owned by Reddit co-founder Alexis Ohanian, participated in a $100 million Web3 Growth Fund alongside Solana Ventures in November 2021. Ohanian’s 776 firm has now launched two new funds, collectively worth $500 million, dedicated to investing in startups at various stages in their development.

Notably, the future of industry talents attracted Ohanian’s growing interest in digital assets. In a past interview with The Wall Street Journal, Ohanian said that “Talent has never led me wrong,” referring to the massive influx of software developers in the crypto sector.

According to venture firm Electric Capital, roughly 34,000 new developers contributed to open-source crypto projects in 2021, the highest on record.

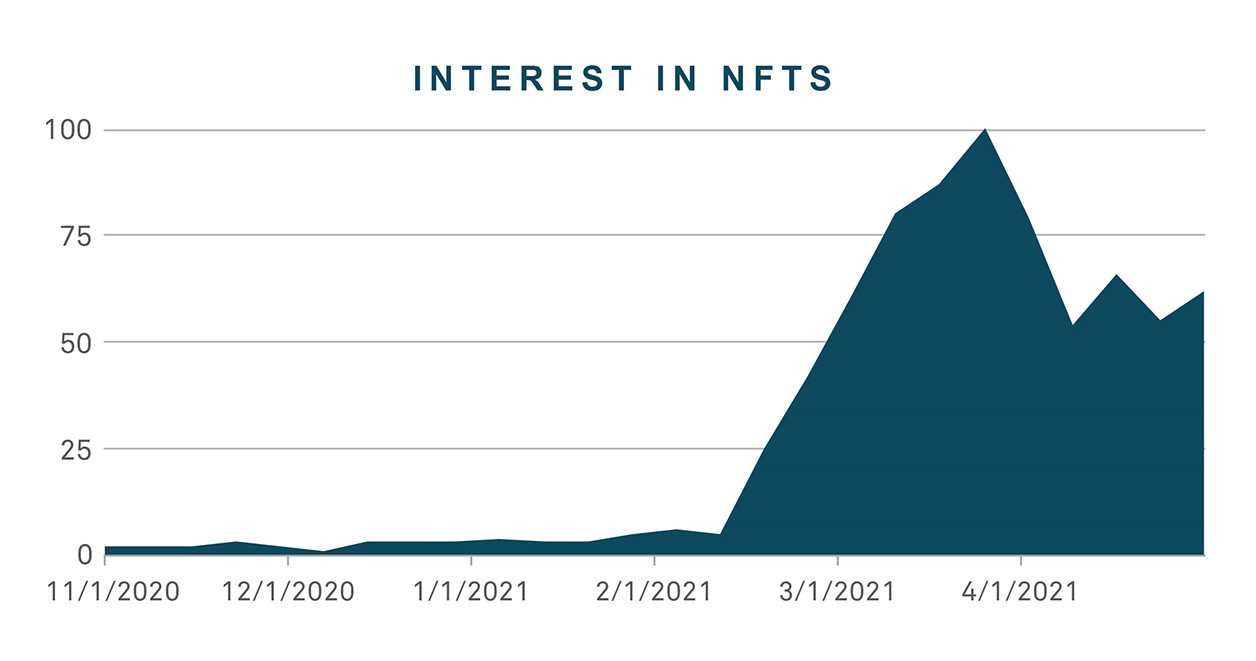

The crypto space keeps growing with more use cases coming up within the sector. Notably, decentralized finance (DeFi) and nonfungible token (NFT) industries are believed to have powered the entire crypto market in 2021.

As developers look into the future with Web3 and the metaverse on the horizon, it is expected that more investors, traders, and users will flock into the digital world in the coming years.

1 comment