NFT prices are continuing to rise, with November 6, 2023, marking their highest volume day in the last three months.

One episode of The Simpsons prominently featured NFTs and sent an excitement wave through the market, powering the movement of derivative projects. CryptoPunks are holding over $90,000, potentially inspired by the news that BAYC co-founder GordonGoner bought a zombie that wore a knitted cap for 600 ETH.

Classic mid-cap collections from 2021 and 2022 are also benefiting considerably, including Cool Cats (up 55%) and Goblintown (up 41%). The PFP-focused rally is yet to translate into fine art collections, with William Mapan’s Anticyclone and Tyler Hobbs’ Fidenzas remaining relatively steady.

Why Did NFTs Surge Abruptly?

Why is the market rallying? Speculation and FOMO? Or is it the Simpsons?

NFTStats, director of research at PROOF, said:

“Every NFT that is rallying seems to have a different driver. My sense is that after the success of $MEME by Memeland and the team at 9Gag, there is excitement about other potential gaming plays with tokens like The-Grapes or Mocaverse. Some on-chain plays like OnChainMonkey and Cyberbrokers have rallied since Elon comments about things being on-chain.

A few older memes like Toadz and SupDucks are rallying. The other thing is that as projects get more volume, they become more attractive targets both for Blur farmers and Flooring Labs, which can bring more traders in.”

Sergito, Punk, and senior director at Fireblocks, believes the rally is straightforward. He commented:

“From a macro perspective, the upcoming recession has been well-telegraphed, and so the market is now expecting financial conditions to be loosened by the authorities to combat that in 2024.

Markets trade-off expectations, so a recession is potentially good for risk assets due to the expected response. Wild, I know. As it pertains to NFTs, we’ve seen liquidity flow from spot crypto into jpegs, as is usually the case. With the demise of SocialFI and the end of season 2 of Blur farming, the attention has returned to trading NFTs.”

In all seriousness though… the World Economic Forum published a 50-page report on NFTs last month.

You can download it here: https://t.co/2wxQfV7DzH pic.twitter.com/r3AOXSE9BX

— Sergito (@sergitosergito) November 6, 2023

With that said, the mainstream notion that “NFTs are dead” has proven misguided. Although venture capital investment has steeply dropped since the days of the bull market, firms that have survived the crypto winter and new innovators are coming up with important uses of NFT technology, pinning lots of hopes on mass adoption, not the floor price.

Moments before the rally, a World Economic Forum fellow for blockchain and digital assets and associate partner at Bain & Company, Juan Redondo Cánovas del Castillo, published an Insight Report on the Evolution of Non-Fungible Tokens. The report looks at NFT technology in general, the challenges that hinder its widespread adoption, and steps developers can implement to achieve mass adoption.

If you think NFTs are just expensive jpegs, this @wef report exploring their future adoption using a taxonomy of 10 use cases is worth a read: https://t.co/UTQYAi7lyp

— Tara Tiger Brown Ⓥ 🌲💚 (@tara) November 6, 2023

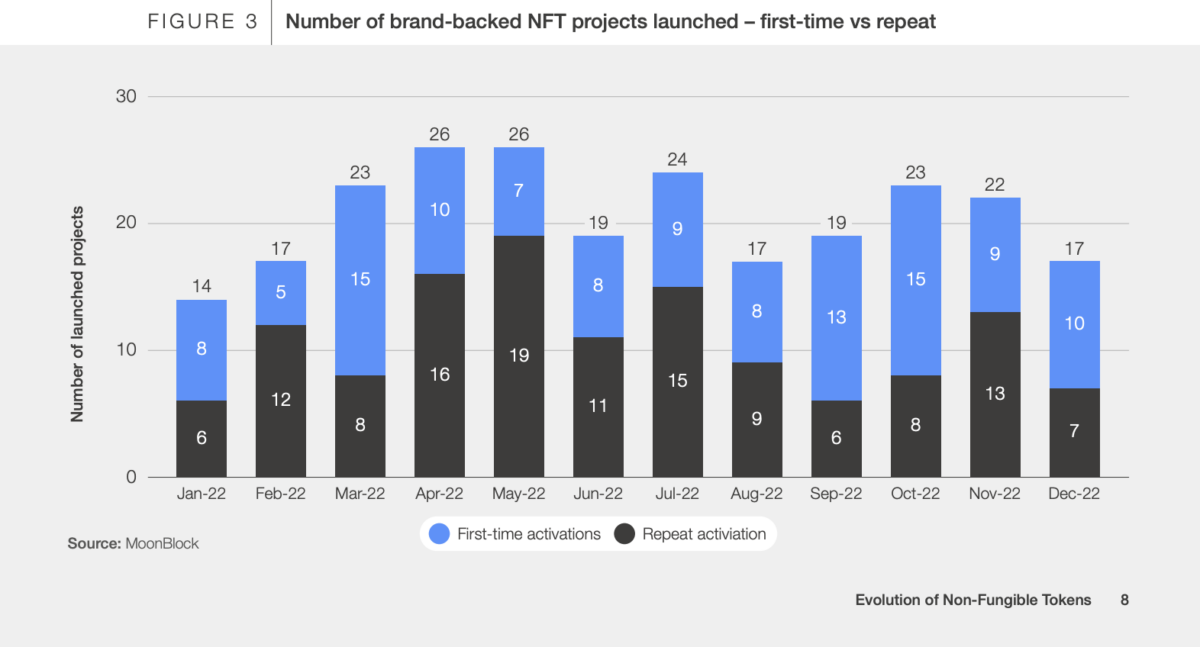

The report briefly outlines the technology’s history, focusing on its practical applications for business and industry, covering ten distinct use cases, rather than the artistic and collectible aspects that drew people to space in 2021.

These run the gamut – Starbucks unleashing its loyalty program on Polygon, collections launching from Budweiser and Puma, and financial services using NFTs to structure loans and luxury brands that certify physical assets. Sergito said:

“The WEF report is a 30k-foot view of tokenized assets. I think people within the space sometimes are very narrow-minded in their view that “NFTs” refer to the tokens that have been trading for the last two years. The reality, though, is that NFTs are file formats that enable digital asset ownership, and thus there will be many industrial and commercial cases for NFTs which are not related to the JPEGs we love.”

This report is a great tool for advocates: across the board, more big companies continued developing their crypto and NFT plans than would be expected, considering the mainstream doomsayers. But it also warns of issues that have to be overcome for NFTs to thrive and grow. They include interoperability issues – regardless of how we champion our ideal blockchains, ease of transfer between platforms and networks will build lots of growth.

Regulatory clarity is also important: the report insists that IP rights protection, straightforward regulations, support for data privacy, anti-money laundering compliance on all platforms, and tax compliance tools are the minimum requirements for mass adoption.

Therefore – is the report bullish? Sergito concluded:

“The most important takeaway is that the world is noticing our technology. The narrative that NFTs were dead because floor prices had fallen 90% was wrong. NFTs are seeing increased adoption from traditional companies and industries. These entities move at a much slower rate, but they are exploring the technology, and that is good for the digital asset space.”