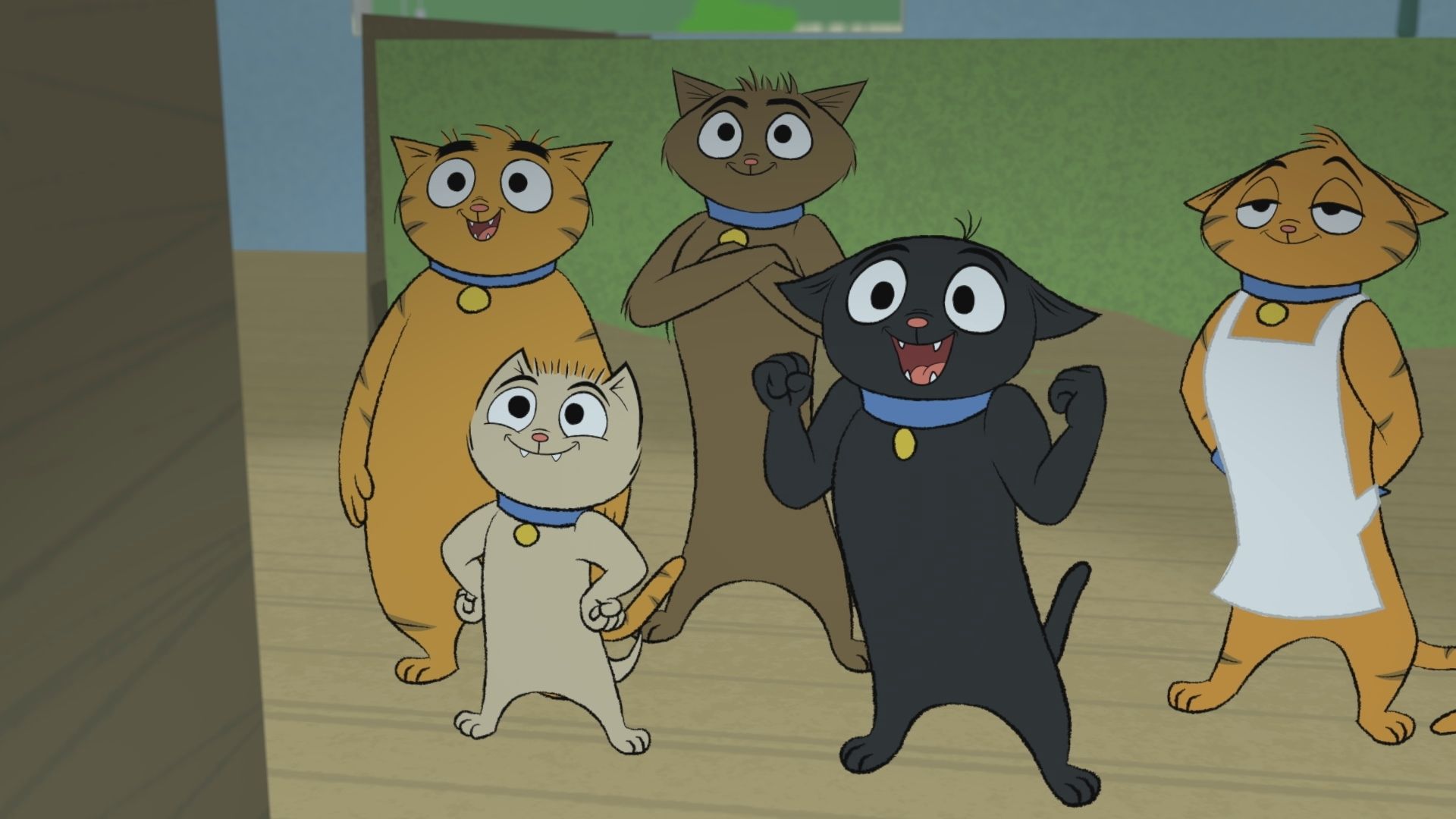

The Stoner Cats NFT initiative, co-founded by the esteemed actress Mila Kunis, has faced trading restrictions on several major NFT platforms such as OpenSea, Blur, and Rarible. This development comes in the wake of legal action by the United States Securities and Exchange Commission (SEC), which has levied charges against the project’s creators, alleging the unauthorized sale of securities.

The Rise Of Stoner Cats

Debuted to the public in 2021, the Stoner Cats NFTs, associated with an animated series featuring a star-studded cast, quickly garnered attention from both collectors and investors. These digital assets, utilizing the Ethereum blockchain, were readily available for trading across various platforms. By July 2021, the project had posted remarkable sales figures, having sold more than 10,420 NFT passes, generating an initial collection exceeding $8 million.

Nevertheless, the project has recently encountered regulatory scrutiny from the SEC, resulting in a temporary setback. In response, OpenSea and Blur, recognizing the legal implications, have suspended active listings associated with Stoner Cats NFTs. Similarly, Rarible has taken a cautious stance by completely removing the project from its platform.

It is important to emphasize that the NFTs themselves have not disappeared; they continue to exist securely on the blockchain, residing in the digital wallets of their respective owners. Some platforms, such as LooksRare and X2Y2, have chosen to list these NFTs, allowing current holders the option to trade them if they wish to do so.

SEC’s Involvement And Its Effect On The Market

The SEC’s involvement in this case can be seen as indicative of the regulatory authority’s increasing attention to the swiftly evolving NFT landscape. Following the allegations, the creators of Stoner Cats chose to settle. They agreed to pay a substantial civil penalty of $1 million, with the funds designated to establish a Fair Fund. The primary purpose of this fund is to expedite the reimbursement of investors who may have been affected.

An intriguing market trend emerged in the wake of the SEC’s announcement. While one might have anticipated a decline in the value of Stoner Cats NFTs due to the legal challenges, the opposite occurred. The market experienced an increase in the trading volume of these NFTs, and their prices saw a significant rise.

These unfolding events emphasize the significance of regulatory clarity in the constantly evolving NFT world. As the NFT space continues to grow and draw substantial investments, the need for investor protection and adherence to established securities laws becomes increasingly critical.

The Takeaway

The Stoner Cats situation stands as a crucial case study, shedding light on the intricacies and subtleties inherent in the NFT market. Despite the hurdles encountered by the project, its ability to thrive in the aftermath of the SEC’s involvement underscores the enduring demand and enthusiasm for NFTs among both digital collectors and investors.