A significant event took place recently, but it went unnoticed by much of the cryptocurrency community as most investors focused on Bitcoin’s phenomenal recovery. This involved Ethereum (ETH) founder Vitalik Buterin and two Dogecoin (DOGE) developers Ross Nicoll and Oscar Guindzberg. The trio started a videoconference as confirmation that the much-requested DOGE-ETH bridge is already up and running and development is progressing well. This project was started in 2018 by DOGE developers, but shelved indefinitely during the cryptoactive winter of 2019. However, since ETH founder Vitalik Buterin and Elon Musk proposed that the two influential coins work together in June of this year, the project was restarted and was progressing very well.

The emergence of Buterin as a form of support is important, as it has an influence on ETH and the crypto community. Your support for the project makes it especially legitimate and viable.

So what is this DOGE-ETH bridge all about?

Simply put, a DOGE-ETH bridge allows DOGE to be used on all ETH-based platforms. A bridge allows DOGE holders, who currently lack smart contract capability, to use their DOGE to join the ETH metaverse, which comprises a growing list of revolutionary innovations, from financial systems to new economic systems. This basically means that DOGE holders will be able to participate in DeFi, NFT, Gaming, DAO, among other things.

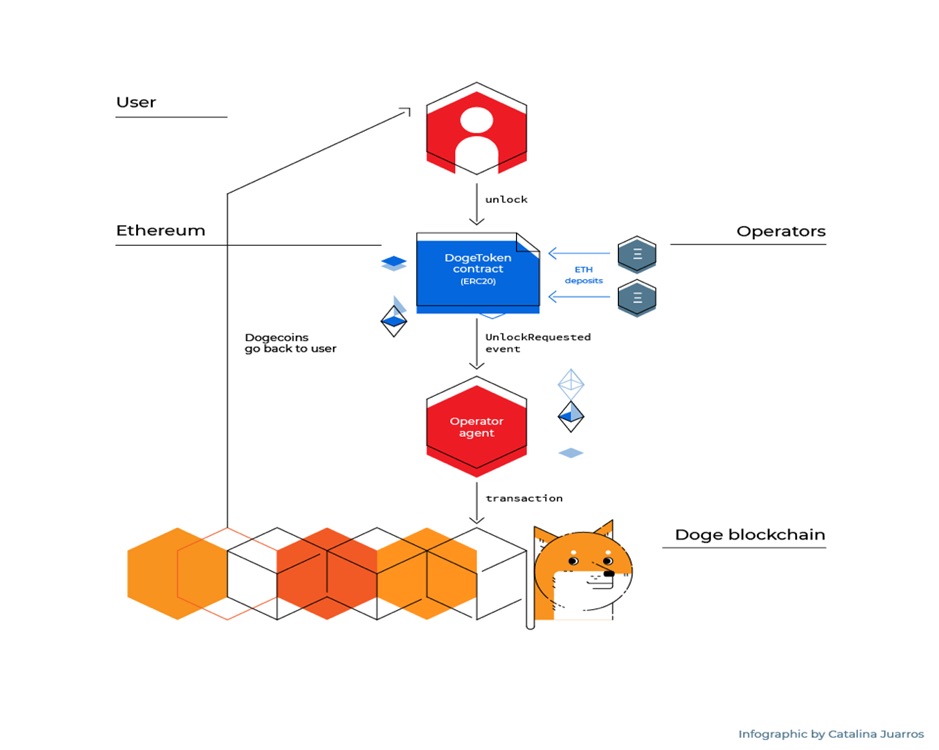

This bridge works by allowing the DOGE to be locked into a smart contract, which then mints an equivalent amount that represents it into the ETH blockchain (via the ERC-20 token pattern). Basically, it allows you to create an ETH version of DOGE that you can use just like ETH, and from there, returns your DOGE in all its glory after you’ve finished doing what you wanted to do on an ETH-based platform and you want your DOGE to come back.

While this is certainly great news for DOGE, it could be even better news for ETH. In order not to make this article too long, I’m not going to go into detail about how the bridging process works (you can read the flowchart below).

The key to note is that the way this bridge works, at least in its current form, requires the use of ETH as a gas charge and also that ETH be placed as a guarantee for participants who wish to become the “gatekeeper” . the smooth process of this “input and output transformation”. Instead of having a centralized entity that oversees DOGE locking and unlocking, the entire process is done through an intelligent contract that will be governed by a series of “gatekeepers” called Bridge Operators. To become a bridge operator, the participant must put some ETH as collateral. This process is somewhat similar to ETH’s participation in ETH2.0, where validators will need to put ETH as collateral to protect the new PoS network. And just like the ETH2.0 validators, these bridge operators will receive a reward.

Therefore, this bridge could increase the use of ETH in terms of gas tariff payable, but not only that, it also reduces the circulation of ETH supply, as bridge operators will have to block their ETH. Although the details of the ETH lock are not yet available, this will invariably cause demand for ETH to increase and the market supply of ETH to decrease. The launch of this bridge will inevitably exacerbate the already severe ETH supply crisis, further increasing its price over time. This newly created pricing catalyst adds to current exciting developments within the ETH ecosystem that no longer need an introduction.

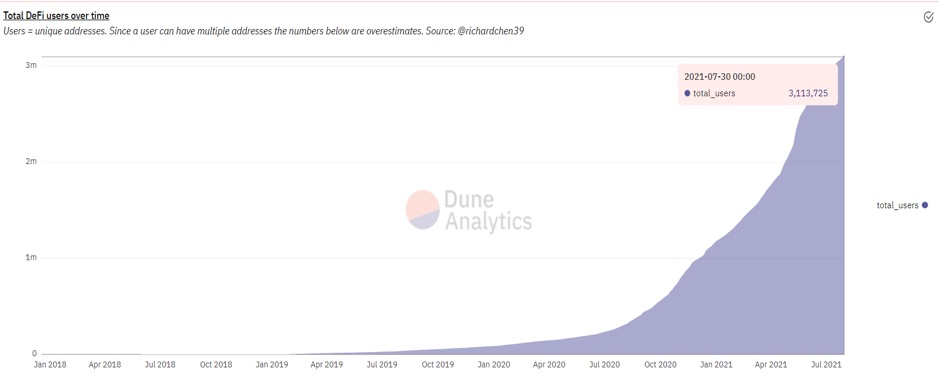

It is widely accepted that the phenomenal rise in the price of ETH over the past year was driven primarily by the rise in popularity in the DeFi, NFT and blockchain gaming arena, where ETH remains the undisputed leader. Despite this market leadership position, the number of DeFi users, which represents over 90% of ETH usage, is only about 3 million out of a world population of over 7 billion; there is still plenty of room for growth.

It is also a widely accepted fact that DOGE is the cryptocurrency with the highest number of exclusive holders, most of which are new entrants to the cryptocurrency space that are likely not exposed to ETH, let alone the DeFi and NFT ecosystems.

While it is difficult to determine the number of DOGE users, we can make a rough estimate by looking at social media numbers. There are currently over 2.1 million subscribers on DOGE’s subreddit account, while its Twitter account has over 1.9 million followers, both of which are the highest among all currencies. Robinhood’s recent IPO process also showed how important DOGE has been to its business, as DOGE’s operations accounted for 34% of its cryptoactive revenue in the first quarter of 2020, a drastic increase of just 4% from the previous quarter. Experienced cryptocurrency investors generally don’t use Robinhood to make their cryptoactive purchases, they usually do so in cryptocurrency exchanges only. Thus, we can safely deduce that the majority of these DOGE buyers in Robinhood are new entrants to the cryptocurrency space in the first quarter of 2021 and may not have participated in DeFi or NFT.

If this large group of new users enter ETH-based platforms through the DOGE-ETH bridge, the increase in ETH usage could be massive. DOGE’s user-friendly appeal has been able to continually attract more new entrants to the cryptocurrency space, as well-known consumer-focused companies such as Slim-Jim and even Burger King have incorporated the popular currency into their marketing campaigns, making it even more popular. Therefore, DOGE not only brings its current holders into the ETH ecosystem, but also has the potential to attract many more new users.

The bridge will also greatly benefit DOGE as it creates an additional use case for DOGE that could increase demand and, more importantly, block some of DOGE’s supply when its replica version on ETH is used in multiple applications on ETH, based platforms. As more DOGEs are blocked for use and/or income generation purposes, the current supply of DOGE in the market will be reduced, as these blocked DOGEs will not be available for sale, which will remove sales pressure and be beneficial to the price.

In conclusion, this bridge is great news for ETH as it can potentially bring a host of new entrants into the world of DeFi and NFT, while giving DOGE holders the ability to participate in the world of decentralized finance, gaming and governance and much more, which is not currently available to DOGE holders.

The world’s most popular token (DOGE) working alongside the world’s most used token (ETH) is a formidable combination that could potentially trigger even more explosive growth in two already highly ranked cryptocurrencies.

Will the power of DOGE be what ETH needs to send it beyond BTC? And will the ETH-enabled additional use case send our favorite DOGE to the moon before the Dogefather in January? I, like many others, can’t wait for the bridge to go live. This is an exciting development worth keeping an eye on. So much for the moon I would say.

About Kim Chua, Market Analyst at PrimeXBT:

Kim Chua is an institutional trading specialist with a successful track record that spans major banks including Deutsche Bank, China Merchants Bank and others. Over time, Chua launched a hedge fund that consistently delivered triple-digit returns for seven years. Chua is also an educator at heart who developed her own trading curriculum to pass her knowledge on to a new generation of analysts. Kim Chua closely follows the traditional and cryptocurrency markets and is eager to find future investment and trading opportunities as the two very different asset classes begin to converge.

Kim Chua is an institutional trading specialist with a successful track record that spans major banks including Deutsche Bank, China Merchants Bank and others. Over time, Chua launched a hedge fund that consistently delivered triple-digit returns for seven years. Chua is also an educator at heart who developed her own trading curriculum to pass her knowledge on to a new generation of analysts. Kim Chua closely follows the traditional and cryptocurrency markets and is eager to find future investment and trading opportunities as the two very different asset classes begin to converge.