Although the cryptocurrency market is recent, new developments appear every day. In this crypto world, technology acts for greater security of data and assets. One of these great innovations is the growth of decentralized exchanges (DEX).

What is DEX?

DEX is a peer-to-peer (P2P) service that allows the direct transaction of cryptocurrencies, like Bitcoin, between two interested parties.

The goal is to create P2P markets directly on the blockchain. In this way, traders can store and operate cryptocurrency transactions without the need for intermediaries. These exchanges are supervised automatically or by the traders themselves.

In addition, asset security is provided through distributed ledger technology (DLT).

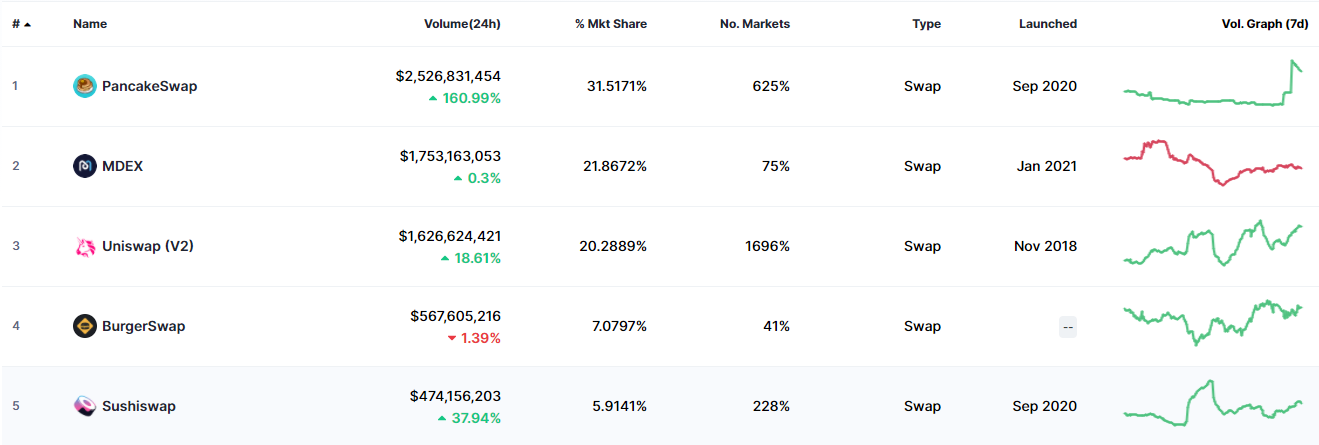

In the chart below, you can see the top cryptocurrency DEXs, according to CoinMarketCap.

How does DEX works?

On decentralized platforms, users maintain custody of their active crypto within their respective portfolios and interact in the order book through DeFi smart contracts, where they publish trading orders. Exchanges take place directly between interested parties, without going through the central agent’s wallet. Thus, the transaction is much more secure.

There are several types of DEX. They can be divided into the following categories:

Order books on the network

A DEX that uses network order books stores all records on network nodes. In addition, this type of decentralized exchange requires the operation of miners to confirm each transaction.

Examples of DEX platforms that use order books on networks are the Bitshares and StellarTerm exchanges.

Off-line order books

Unlike DEXs that use order books within the network, transaction records in books outside the network are hosted at centralized entities. “Retransmitters” are used to assist in the management of these order books. In this context, DEXs in the order book outside the chain are not fully decentralized.

Examples of DEXs that use order books outside the network: Binance DEX, 0x and EtherDelta.

Automated market makers (AMM)

Automated market makers became popular in 2020, driving much of the “DeFi Fever”. AMMs are used by popular platforms such as: Uniswap, SushiSwap and Kyber Network.

This type of DEX does not need order books. Instead, smart contracts are used to form liquidity pools. These pools, in turn, automatically execute trades based on pre-established parameters.

Centralized vs. decentralized exchanges

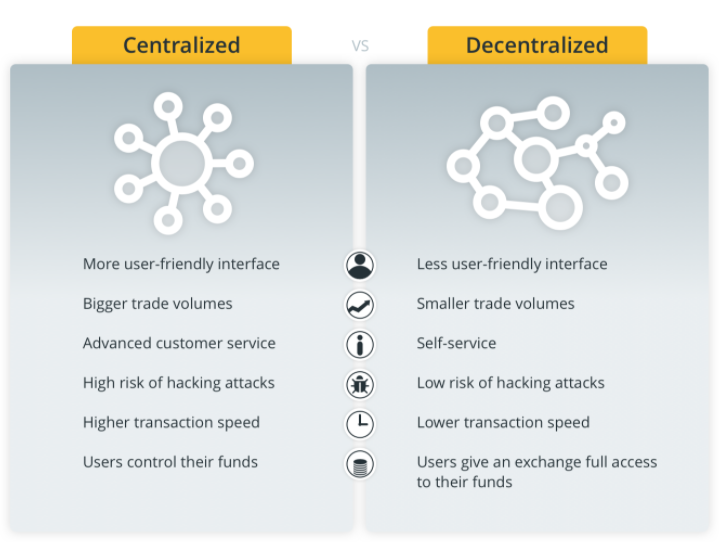

The main difference between a centralized exchange and a DEX is that in the centralized one, users must be identified and their currencies are kept in the accounts belonging to the companies.

These exchanges are managed by intermediaries. Usually, specialized companies or people focused on making a profit.

Centralized exchanges are responsible for protecting user data and business information. Thus, they fully control the operation of the platform and make important decisions for the development of the service independently.

DEXs, on the other hand, allow cryptocurrency transactions to take place directly between participants. For this, a distributed record is used to store and process the data.

User data and their funds are not stored on DEX and the servers function only as a platform for buying and selling cryptocurrencies between interested parties.

In addition, decision making is managed automatically or semi automatically by the participants, through involvement in the platforms.

What are the advantages of DEX over centralized exchanges?

Most of the strengths of decentralized exchanges stem from their distributed architecture and the lack of a single control center. However, other advantages are worth mentioning.

Safety

The custodial nature of centralized exchanges is often cited as the main reason why they are common targets for hackers and scammers. This type of exchange guarantees your liquidity by keeping your users’ funds on the platform. In this way, they are susceptible to theft on a large scale.

Decentralized exchanges do not store user assets. As a result, they are less susceptible to these types of risks. Furthermore, it would not be profitable for hackers to steal funds from individual users, as it would probably be very expensive and difficult.

Privacy

Unlike any centralized exchange, DEXs do not require registration to meet the Know Your Customer (KYC) requirement.

Since the personal data of interested parties is not stored by any central authority, there is no need to use KYC protocols. This provides users with privacy when trading on DEXs.

Low risk of manipulation

Another advantage of DEX is the minimal risk of price manipulation or falsifying transaction volumes. In decentralized exchange, there is no central structure interested in manipulation.

There are also no personal accounts in the decentralized structure. In addition, no verification is necessary, nor is it necessary to specify an e-mail address, so that all users’ personal data remains confidential.

Independence of regulators

At DEX, control of funds can be exercised directly by interested parties. The distributed architecture protects the exchange from interference by local or international authorities.

Centralized structures are regulated. This means that the exchange service can be blocked in whole or in part. In that case, the service becomes limited in terms of location or options.

Accessibility for different projects

Unlike centralized exchange, DEX makes it possible to not only order existing cryptocurrency orders, but also to create new currency orders directly on the system.

This allows start-up projects to provide minimal liquidity, without having to pay high fees for listing on major platforms.

Could DEX be the future of cryptocurrencies?

DEXs were created as a way to maximize ROI and the convenience of cryptocurrency transactions, while preserving sensitive user data.

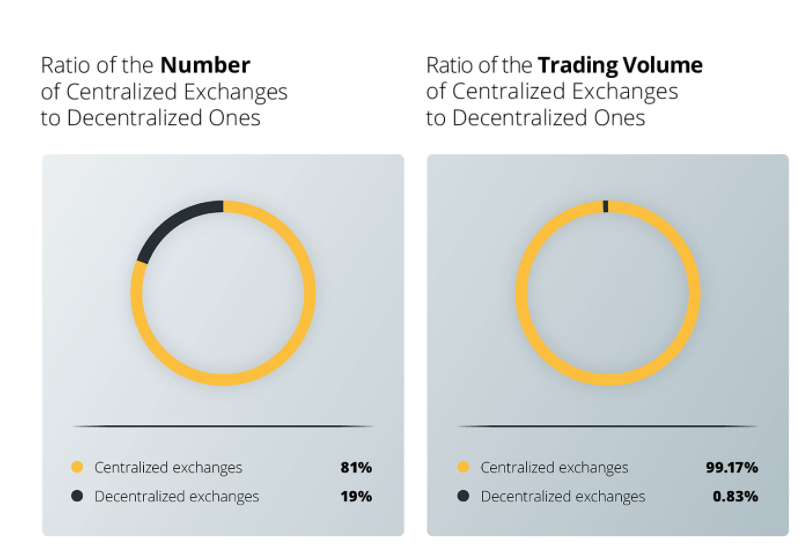

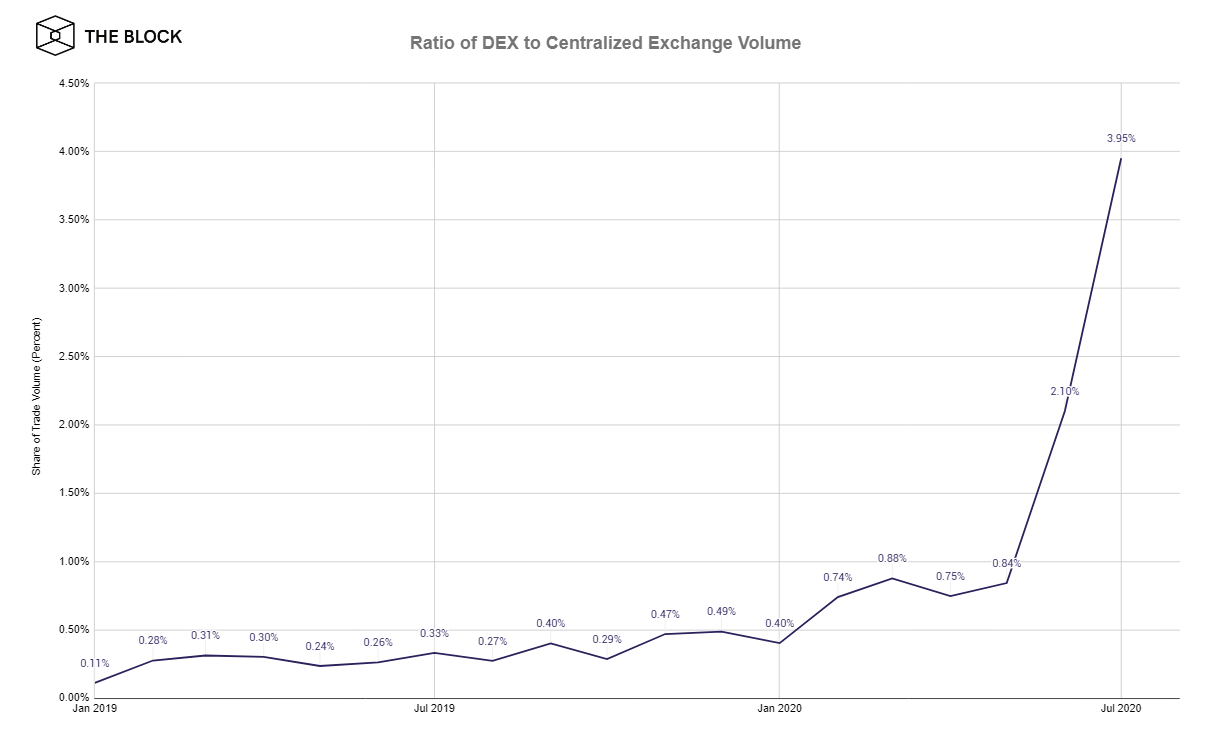

Two years ago, the number of centralized exchanges was 62% higher than DEXs. In addition, the trading volume was almost 99% higher. In the charts below, it is possible to observe the proportion between the two types of exchanges.

However, in July 2020, decentralized exchanges reached a new volume record, exceeding USD$4 billion. In addition, the proportion of DEX exchange volume to centralized, reached almost 3.95%, according to The Block Research. The value represented a jump of 2.1%. Before June, the proportion had never exceeded 1%.

One of the reasons for explaining this positive trajectory is the emergence of new technologies that increase the scalability of decentralized exchanges, which leads to a more competitive exchange offer in relation to centralized counterparties.

These technologies are still preparing to receive some billions from the global market with greater security. However, with the power in the hands of individuals and the constant evolution of DeFi, experts say that the current disadvantages of DEXs will dissipate over time and that we are moving towards a borderless future in asset exchanges.