Coinbase makes its first public appearance on Nasdaq and shares soar by nearly USD$100 billion.

After Nasdaq debut, Coinbase shares rise 5% in less than an hour

On Wednesday (April 14), Coinbase, the largest cryptocurrency exchange in the United States, debuted its shares on the American exchange Nasdaq. The startup marked Wall Street as the first company of its kind to have papers listed.

Launched under the COIN code, the initial public offering (IPO) of Coinbase Global Inc. came together with advances in the debate on cryptocurrencies in several spheres of the United States – including the Federal Reserve.

It is worth mentioning that digital currencies are already being incorporated into business plans and accepted for payment by large corporations such as Tesla, PayPal and Visa.

The startup initially set a reference price of USD$250 for its shares. A few minutes after the IPO, the shares had already reached the mark of USD$402.60. The value represents a jump of more than 5% in relation to the newly established initial price. An hour later, however, the papers were trading at USD$369.

Coinbase IPO closes the day at $ 85.78 billion

Throughout the day, the exchange’s assets were traded to open at USD$381. The value represented an increase of 52%. Such valuation puts Coinbase’s market value at USD$99.6 billion.

According to CNBC, that figure placed the company among the 85 most valuable companies in the USA. At the high of the day, the shares jumped 71% to USD$429.54.

However, at the end of the day Coinbase’s shares lost momentum, ending the day at USD$328.28. The value represented an increase of 31.31% in relation to the Nasdaq-defined IPO prior to the first trade.

Thus, the cryptocurrency exchange ended the first publicly traded day with its market value quoted at USD$85.78 billion. This market value makes Coinbase one of the largest publicly traded American companies. Only 93 companies in the S&P 500 index have a higher market value.

Is it the beginning of “crypto-economy”?

Founded in 2012 in San Francisco, Coinbase aims to simplify the purchase of Bitcoin and other cryptocurrencies. Without the need for intermediaries to carry out transactions, the startup became the most popular cryptocurrency exchange in the USA.

Along with the rise of Bitcoin and Ethereum, Coinbase’s market value has skyrocketed; in its last round of private financing in 2018, investors valued the company at USD$8 billion.

Like many startups in the crypto world, Coinbase has positioned itself as having the potential to disrupt the global financial system.

In a document to the Securities and Exchange Commission (SEC), the exchange wrote that currently the way individuals spend, invest, save and manage their finances is often cumbersome. “We are building the crypto economy – a fairer, more accessible, efficient and transparent financial system for the Internet age,” said Coinbase.

Investors are also convinced that crypto is the future of finance.

Today was a landmark moment.@coinbase IPO’d & crossed a $100B. @GoldmanSachs is worth $115B. @Citi is worth $150B. I wish I could be in their boardrooms—talking about how they missed it & how it’s the finance industry’s “Kodak moment.”

Crypto is the future of finance.

— Ian Lee 💭 (@ianjohnlee) April 14, 2021

Is it worth investing in Coinbase’s IPO?

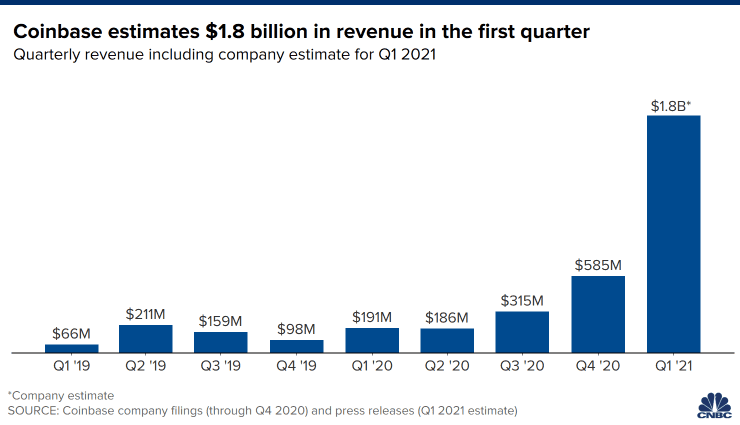

In its earnings report for the first quarter of the year, Coinbase said it had 56 million verified users and 6.1 million carrying out monthly transactions. In addition, the company had a goal of obtaining US $ 1.8 billion in revenue in the period.

Experts say Coinbase’s public offering shows that more Wall Street banks and other traditional investors are open to the idea of cryptocurrency. However, the volatility of this market must not be ruled out.

Coinbase earns 0.5% of the value of each transaction carried out on its system. Therefore, if cryptocurrency prices fall, the commissions that the exchange receives will also fall. This gives the company some exposure to the rise and fall of digital currencies.

Coinbase skeptics have trouble believing that a company that depends on fees can stick to aggressive prices, especially in a market where there is a growing list of rivals.

“As the cryptocurrency market matures and more companies inevitably pursue Coinbase’s high margins, the company’s competitive position will inevitably deteriorate,” wrote New Constructs.

These skeptics believe in a future in which financial intermediaries will be reduced and transactions will take place predominantly on the blockchain.

20/ There’s a saying that the best way to predict the future is to create it. Hopefully we helped make the future happen a little sooner than it otherwise would have in the crypto space.

— Brian Armstrong (@brian_armstrong) April 14, 2021

For Changpeng Zhao, CEO of Binance, a Coinbase competitor, “having a cryptocurrency exchange listed on Nasdaq is a sign that the traditional market is accepting crypto”. It is a significant milestone for the entire industry. This opens the way for many other crypto businesses to follow. I want to applaud Coinbase and Brian Armstrong [CEO of the company] for this achievement,” he said.

In the following video, experts also address the importance of Coinbase’s IPO to investors and the crypto market.

If Coinbase is right, the company is at the center of a critical transformation of the web and the crypto market.