Bitcoin and other cryptocurrencies slump after China issues new statement against digital currency transactions

China is against Bitcoin and other crypto

China’s central bank issued a statement on Monday, June 21, aimed at the country’s main financial institutions , requiring all transactions and services involving cryptocurrencies to be suspended immediately. The ban became official in mid-March, but today’s warning reinforced negative sentiment about the market, causing Bitcoin (BTC), ether (ETH) and other major digital assets to plummet.

According to the statement from the People’s Bank of China (PBOC), banks must not provide products or services such as trading, clearing and settlement for transactions involving cryptocurrencies. The Chinese government also highlighted that these institutions need to identify accounts linked to digital asset exchanges and exchange houses and suspend their activities.

Even though this ban in China on cryptocurrencies was already approved about a month ago, which led to a $750 billion devaluation in the market value of digital currencies, the PBOC addressed specific institutions in the new document. The top names in Chinese finance were notified: The Industrial and Commercial Bank of China, Agricultural Bank of China, Construction Bank, Postal Savings Bank, Industrial Bank and the payment platform Alipay (China).

Bitcoin and major cryptocurrencies plummet

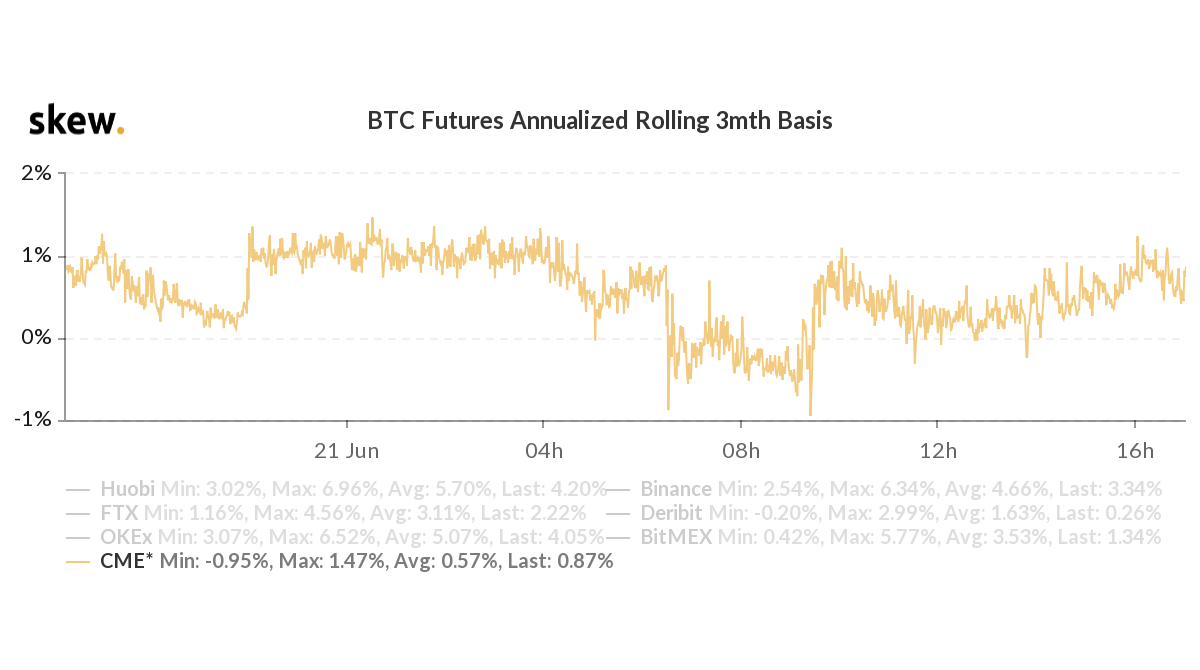

With the ultimatum, the prices of major digital assets plummeted throughout Monday. Bitcoin, the largest and most important cryptocurrency on the market, dropped about 10% in less than 24 hours, trading at a low of $31.7k in the morning of the same day, according to the CoinDesk index. The asset’s record is almost $65,000, reached in mid-April. Since then, prohibitionist measures and shutdowns of digital currency mining facilities in China have pulled its price down.

Along with bitcoin, ether (ETH), the second-largest cryptocurrency on the market and native to Ethereum’s blockchain, also suffered a sharp drop today. The asset lost about 15% in value in 24 hours, trading for less than $1,900 on Monday morning. It is the first time since May 23 that the currency has dropped below $2,000.

Market Wrap: Bitcoin faced its biggest daily drop in more than a month. Several market indicators have turned bearish after China restated its bans on crypto trading. @MuyaoShen reports.https://t.co/sbUEyONT3D

— CoinDesk (@CoinDesk) June 21, 2021

Bitcoin: A threat to the economic and financial order

China’s monetary and fiscal authorities believe cryptocurrencies are risky. After meetings between various government agencies, the PBOC concluded that transactions and services involving digital currencies represent a pathway that facilitates illegal international transactions and money laundering. Furthermore, its use as a financial asset would be a threat to the economic and financial order.

The document issued on Monday also specifies that all institutions alerted have agreed to comply with the new guidelines of the Chinese central bank. The Postal Savings Bank, the Alipay payment platform and the Agricultural Bank of China have already published statements saying they will ban cryptocurrency services and transactions.

In addition to the latest statement berating China’s digital assets, the price of bitcoin was also affected by the wave of crackdowns on miners in the country, which dropped the global cryptocurrency hash rate by at least 25% over the weekend. Last Friday, the government of the Chinese province of Sichuan, one of the main bitcoin mining areas in the country due to the large supply of hydroelectric power, issued an order to suspend the supply of electricity to 26 local facilities dedicated to extracting the asset. .

Insider sources within the Sichuan government told the Global Times that up to 90% of bitcoin mining activities in China are estimated to be closed. With the hash rate affected, the blockchain, the network that supports the operations of the cryptocurrency, weakens and the availability of new units of the asset becomes even more restricted.

How does Bitcoin mining work?

To mine Bitcoin it is necessary to have a computer with high processing capacity. Due to the difficulty of mining Bitcoin, it is currently no longer possible to do it with your home computer. Miners buy machines that are specially made to mine bitcoin, such as ASICS, which have become popular in Bitcoin, becoming the quintessential optimized set of specific processors for block mining.

Their role is to find a sequence that makes a block of bitcoin transactions compatible with the previous block. To do this, the computer needs to perform thousands of calculations per second to find the perfect match, which is why they need to be extremely powerful.

Upon finding the matching streak, the miner receives a bitcoin reward for each block he mines. This reward was created with the intention of paying people who lend computing power to keep the bitcoin network working, known as the blockchain.

The Blockchain is a specific type of database. It differs from a typical database in the way it stores information; blockchains store data in blocks that are then chained together. As new data comes in it is entered into a fresh block. Thousands of miners compete daily for the reward the blocks offer.