After comparing Bitcoin investment to car combustion, Elon Musk refuses Bitcoin as a payment method at Tesla.

Bitcoin, Tesla and the environment

Elon Musk announced on Wednesday, 12, that Tesla, his electric car maker, will no longer accept Bitcoin (BTC) as a form of payment. The announcement was made through the billionaire’s Twitter account and the main reason for this is to preserve the environment.

According to the CEO of Tesla and SpaceX, the company would be concerned about the rapid increase in the use of fossil fossils ”related to cryptocurrency. In addition, despite the digital asset “being a good idea, it cannot have a great cost to the environment”.

Musk ended the publication by explaining that Tesla is not going to sell more bitcoins just for now. According to the billionaire, his company intends to return to accepting the currency “as soon as mining transitions to more sustainable energy”.

Tesla & Bitcoin pic.twitter.com/YSswJmVZhP

— Elon Musk (@elonmusk) May 12, 2021

Tesla started accepting Bitcoin in March this year. However, the change of position makes sense, since Musk is known for his great speeches in defense of the environment – great for selling his electric cars.

However, such a change in position needs context. In February, the billionaire had entered a reverse carbon credit market. At the time, its automaker bought $1.5 billion in Bitcoin, something that drew criticism from environmentalists and experts from the crypto market.

Bitcoin pollution?

In his publication, Musk makes it clear that the suspension of Bitcoin at Tesla is associated with the use of fossil fuels during the mining process of the cryptocurrency, “mainly coal that has one of the worst emissions of any fuel”.

For comparison, a study carried out by the University of Cambridge, points out that the mining of digital coins consumes about 130.9 terawatt-hours (TWh) per year. This results in a higher energy expenditure than is consumed in Argentina.

Another study, conducted by the University of the Chinese Academy of Sciences, says that China is at the top of so-called carbon (CO2), reaching 130.50 million tons of CO2 per year. The country is responsible for mining more than 75% of the world’s bitcoins and as a carbon carrier caused by the activity they are larger than one of the 10 largest Chinese cities. This is because to mine cryptocurrencies it is necessary to have computers connected to electricity all the time. As most of the year electricity is via fossil fossils, a CO2 emission ends up being very high in the country.

In his tweets, Musk even released a graph of energy consumption by Bitcoin in recent months, something he considers “insane”.

Energy usage trend over past few months is insane https://t.co/E6o9s87trw pic.twitter.com/bmv9wotwKe

— Elon Musk (@elonmusk) May 13, 2021

In addition, a recent Bank of America study calculated that each $1 billion in bitcoins generates annual carbon emissions equivalent to the amount emitted by 1.2 million cars. In other words, the carbon footprint of Tesla’s investment would be the same as putting 1.8 million cars with an internal combustion engine to circulate. The value, in turn, is more than triple the total cars sold by Musk’s company in 2020.

BTC goes down after Musk announces the end of Bitcoin at Tesla

After Musk’s tweet, Tesla’s shares registered a drop of up to 5% on the New York Stock Exchange.

The price of BTC plunged 6.76%. The price of the cryptocurrency has dropped from $ 54,602.77 to $ 52,147.82.

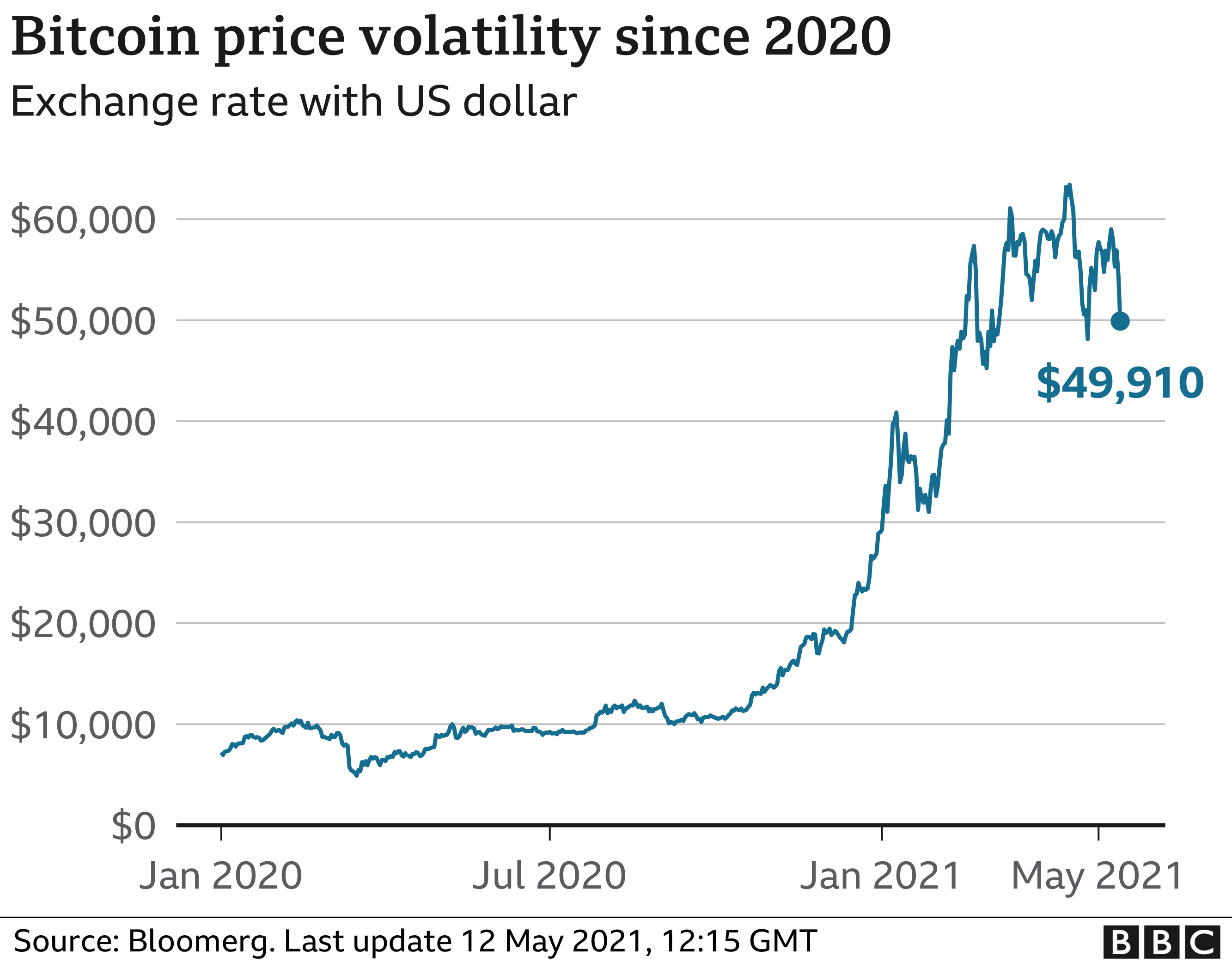

It is worth mentioning that in April, BTC reached its historic maximum, exceeding $ 60 thousand.

In the chart below, it is possible to observe the currency’s volatility since 2020.

Bitcoin today’s price

Currently, Bitcoin is priced at $ 49 thousand dollars and its market cap is approximately $ 924.560 billion. In addition, the cryptocurrency holds 39.73% of the crypto market.

Bitcoin: What do the crypto experts say?

Tesla’s decision to suspend payments with Bitcoin came as a surprise to many crypto analysts, since the automaker had announced just over a month ago the acceptance of cryptocurrency as a means of payment.

Others, however, believe that the attitude of suspending Tesla’s sales with bitcoins could be associated with an attempt to show investors that the automaker is trying to minimize the impacts on the environment and is committed to corporate and socio-environmental governance issues.

Finally, other theories suggest that the decision is a marketing ploy to influence the cryptocurrency market, considering Musk’s strong influence with cryptocurrencies like Dogecoin and Shiba Inu.