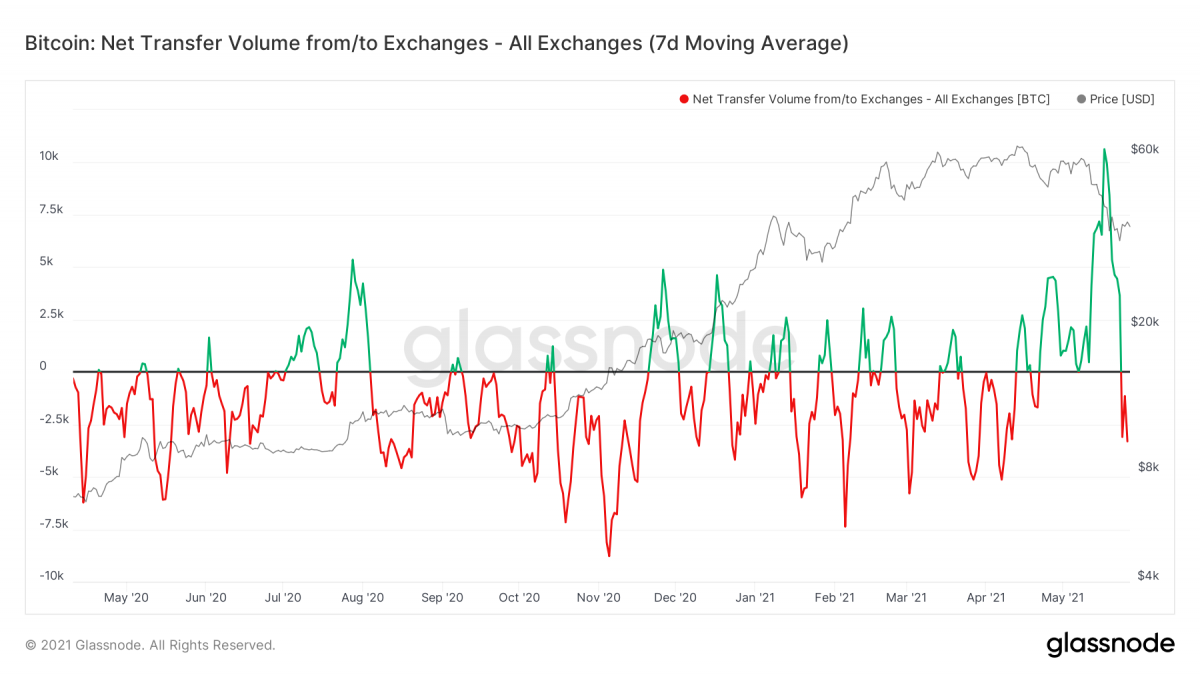

Experts have noticed an increase of Bitcoin outflow from exchanges. This fact could be a sign that investors are still wary of Bitcoin and are taking their coins out of exchanges, given the recent Chinese crackdown on Bitcoin miners and discussions about BTC sustainability.

Bitcoin outflow from exchanges

The flow of Bitcoin into the exchanges was negative for the first time since April 22, according to Glassnode data, signalling a strong Bitcoin outflow in the market. This means that, after five weeks, more cryptocurrencies are leaving than entering brokers, a possible sign that investors are pessimist and that the market is losing strength.

The withdrawal of cryptocurrencies from exchanges means that holders are taking custody of their assets themselves, predicting that they will not put them up for sale very soon. In times of a bear market, the stock of cryptocurrencies on the trading platforms tends to remain low.

When there is a flow of Bitcoin coming back to exchanges, it is a sign that investors want to return their currencies to the market, hoping the prices will go up.

Bitcoin outflow shows there’s panic among investors

The movement of Bitcoin outflow leaving exchanges was a response to the negative news that hit the main cryptocurrency in the market. This was caused by Elon Musk who announced that automotive company Tesla would no longer accept Bitcoin because of the environment.

“We are concerned about rapidly increasing use of fossil fuels Bitcoin mining and transactions, especially coal, which has the worst emissions of any fuel”, said Musk, on his Twitter profile

Tesla & Bitcoin pic.twitter.com/YSswJmVZhP

— Elon Musk (@elonmusk) May 12, 2021

Fans and investors are tired Musk’s huge influence on the short-term price movements of most cryptocurrencies.

“The people who followed Musk blindly lost a lot of money. They got burned and may never come back, ”said Alex Mashinsky, CEO and founder of Celsius.

“The crypto community needs to be more responsible in how it explains these assets and the risk,” added Mashinsky to his Twitter profile in response to the Tweet from Digital Correspondent Paul R. La Monica, who wrote:

“Some long-term crypto HODLers wish Elon Musk would put the phone down and focus more on building cool electric cars and trucks for Tesla and less on what’s going on with bitcoin and doge.”

.@CelsiusNetwork featured in @CNNBusiness on @elonmusk

“The crypto community needs to be more responsible in how it explains these assets and the risk,” added @Mashinsky. https://t.co/Xbk2CDcJLS

— Alex Mashinsky ©️ (@Mashinsky) May 24, 2021

Investors and analysts are particularly irritated that all cryptocurrencies have gone up and down along with Bitcoin and Dogecoin, in part because of Musk’s mood swings over them. Some cryptocurrency investors are also upset, to say the least, that a comment by Musk could move prices so radically.

This even fuelled the rise of the token STOPELON, as a protest to Musk’s strong influence on the value of cryptocurrencies.

This even fuelled the rise of the token STOPELON, as a protest to Musk’s strong influence on the value of cryptocurrencies.

To further panic of investors, on May 21, new measures of the Chinese government were unveiled. Chinese Deputy Prime Minister Liu He told a group of financial officials on Friday (May 24) that the government would “crack down on Bitcoin mining and commercial activity” as part of its goal of achieving financial stability. The government has not put forward specific policies aimed at mining or trading. These moves caused some panic among novice investors who sold their cryptocurrencies at significant losses.

Despite Bitcoin outflow, BTC recovers slightly

After information that Musk was holding a meeting with Bitcoin miners from the United States to discuss the use of clean energy and sustainability in Bitcoin mining, BTC price went up, compared to previous days.

Bitcoin’s price remained stable on Thursday, May 27, but is still struggling to stay above the $ 40,000 barrier. The scenario is the same for the other major cryptocurrencies on the market.

All cryptocurrencies show significant downturn

In addition to Bitcoin, the scenario is the same for the other major cryptocurrencies on the market that are operating stable this Thursday, May 27th.

The Ethereum (ETH) registered a slight increase of 0.75% and is quoted at $ 2,804 on Thursday.

Ripple’s XRP fell 0.23% from Wednesday morning and is trading at $ 1.01. Last weekend the cryptocurrency had plummeted to $ 0.65, hitting its lowest level since early April.

Current prices for ADA, BNB, DOGE and DOT

Cardano (ADA) is quoted at R $ 1.74, with a slight appreciation of 0.58% compared to yesterday morning. Binance Coin (BNB), like the ADA, has also remained virtually stable; the currency trades at $ 374 after falling 0.59%.

Dogecoin (DOGE), which according to billionaire Mike Novogratz is unable to survive in the future, devalued 1.68% and saw its price drop to $ 0.34.

“Dogecoin is a very speculative asset, much more so than Bitcoin. It likely doesn’t have long-term legs

because no institution is buying it and at some point, retail will lose interest. ” – said the billionaire businessman in an interview published last week in a Goldman Sachs report.

Among the leading cryptocurrencies, Polkadot (DOT) is the one with the biggest price increase. The currency reached $ 23.95 after a 4% rise.